Economic forecasting — why it matters and why it is so often wrong

31 Jan, 2023 at 16:11 | Posted in Economics | Comments Off on Economic forecasting — why it matters and why it is so often wrong As Oskar Morgenstern noted in his 1928 classic Wirtschaftsprognose: Eine Untersuchung ihrer Voraussetzungen und Möglichkeiten, economic predictions and forecasts amount to little more than intelligent guessing.

As Oskar Morgenstern noted in his 1928 classic Wirtschaftsprognose: Eine Untersuchung ihrer Voraussetzungen und Möglichkeiten, economic predictions and forecasts amount to little more than intelligent guessing.

Making forecasts and predictions obviously isn’t a trivial or costless activity, so why then go on with it?

The problems that economists encounter when trying to predict the future really underline how important it is for social sciences to incorporate Keynes’s far-reaching and incisive analysis of induction and evidential weight in his seminal A Treatise on Probability (1921).

According to Keynes, we live in a world permeated by unmeasurable uncertainty – not quantifiable stochastic risk – which often forces us to make decisions based on anything but ‘rational expectations.’ Keynes rather thinks that we base our expectations on the confidence or ‘weight’ we put on different events and alternatives.  To Keynes, expectations are a question of weighing probabilities by ‘degrees of belief,’ beliefs that often have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents as modelled by ‘modern’ social sciences. And often we “simply do not know.”

To Keynes, expectations are a question of weighing probabilities by ‘degrees of belief,’ beliefs that often have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents as modelled by ‘modern’ social sciences. And often we “simply do not know.”

How strange that social scientists and mainstream economists, as a rule, do not even touch upon these aspects of scientific methodology that seem to be so fundamental and important for anyone trying to understand how we learn and orient ourselves in an uncertain world. An educated guess on why this is a fact would be that Keynes’s concepts are not possible to squeeze into a single calculable numerical ‘probability.’ In the quest for measurable quantities, one puts a blind eye to qualities and looks the other way.

So why do companies, governments, and central banks, continue with this more or less expensive, but obviously worthless, activity?

A part of the answer concerns ideology and apologetics. Forecasting is a non-negligible part of the labour market for (mainstream) economists, and so, of course, those in the business do not want to admit that they are occupied with worthless things (not to mention how hard it would be to sell the product with that kind of frank truthfulness). Governments, the finance sector and (central) banks also want to give the impression to customers and voters that they, so to say, have the situation under control (telling people that next year x will be 3.048 % makes wonders in that respect). Why else would anyone want to pay them or vote for them? These are sure not glamorous aspects of economics as a science, but as a scientist, it would be unforgivably dishonest to pretend that economics doesn’t also perform an ideological function in society.

Dune Mosse

31 Jan, 2023 at 14:24 | Posted in Varia | 1 Comment.

Un viaggio in fondo ai tuoi occhi “dai d’illusi smammai” /

Un viaggio in fondo ai tuoi occhi solcherò / Dune Mosse …

Dentro una lacrima / E verso il sole / Voglio gridare amore /

Uuh, non ne posso più / Vieni t’imploderò /

A rallentatore, e … / E nell’immenso morirò! …

Un’opera d’arte. Meravigliosa!

Hovern’ engan

30 Jan, 2023 at 14:52 | Posted in Politics & Society | Comments Off on Hovern’ enganWars, conflicts, and other crises have left more than 30 million children displaced from their homes in the world today.

More than 10 million children are refugees or asylum-seeking.

“Whatsoever You Do to the Least of My Brothers You Do unto Me”

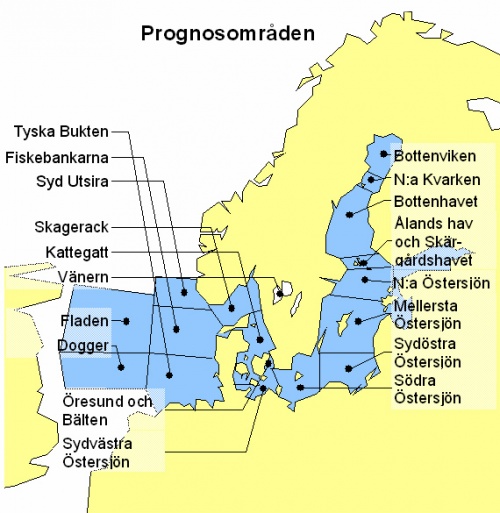

Sjörapportsfilosofi

29 Jan, 2023 at 16:54 | Posted in Varia | 1 Comment I dessa tider — när ljudrummet dränks i den kommersiella radions pubertalflams — har man nästan gett upp.

I dessa tider — när ljudrummet dränks i den kommersiella radions pubertalflams — har man nästan gett upp.

Men det finns ljus i mörkret.

I programmet Text och musik med Eric Schüldt — som sänds på söndagsförmiddagarna i P2 mellan klockan 11 och 12 — kan man lyssna på seriös musik och en programledare som verkligen har något att säga och inte bara låter foderluckan glappa. Att få höra någon med intelligens och känsla tala om saker som vi alla går och bär på djupt inne i våra själar — men nästan aldrig vågar prata om — är en lisa för själen.

Jag har i flera år nu lyssnat på Erics program varje söndag. En helg utan hans tänkvärda och ofta lite melankoliska funderingar och vemodiga musik har blivit otänkbart.

Idag gladde han många av oss som älskar radions sjörapporter med att på sitt vanliga älskvärda och smått filosofiska sätt hylla denna radions eviga följeslagare.

Idag gladde han många av oss som älskar radions sjörapporter med att på sitt vanliga älskvärda och smått filosofiska sätt hylla denna radions eviga följeslagare.

För den som vill somna in skönt till ljudet av vacker musik och sjörapporter är det här ett måste.

Som så ofta de senaste åren är det den eminente Eric Schüldt som får mig att hitta nya ljudintryck. I en tid — många kallar den ‘modern’ — då alla förväntar sig omedelbar behovstillfredsställelse här och nu, njuter jag av att få gå och längta efter nästa söndags musikupplevelse och betraktelser över tillvarons — och sjörapportens — mystik.

Tack Eric!

Vienna

29 Jan, 2023 at 16:31 | Posted in Varia | Comments Off on ViennaBack in 1980 yours truly had the pleasure of studying at University of Vienna.

When not studying or visiting Berggase 19, I often listened to this on my Sony Walkman:

Bright eyes (personal)

28 Jan, 2023 at 17:53 | Posted in Varia | Comments Off on Bright eyes (personal).

People say time heals all wounds.

I wish that was true.

But some wounds never heal.

Even after thirty years you just have to learn to live with the scars.

In memory of Kristina Syll — beloved wife and mother of my son David and daughter Tora.

But in dreams,

I can hear your name.

And in dreams,

We will meet again.When the seas and mountains fall

And we come to end of days,

In the dark I hear a call

Calling me there

I will go there

And back again.

Douter ou ne pas douter …

27 Jan, 2023 at 16:39 | Posted in Varia | Comments Off on Douter ou ne pas douter ….

Hyman Minsky and the IS-LM obfuscation

26 Jan, 2023 at 16:38 | Posted in Economics | 3 CommentsAs a young research stipendiate in the U.S. yours truly had the pleasure and privilege of having Hyman Minsky as a teacher. He was a great inspiration at the time. He still is.

The concepts which it is usual to ignore or deemphasize in interpreting Keynes — the cyclical perspective, the relations between investment and finance, and uncertainty, are the keys to an understanding of the full significance of his contribution …

The glib assumption made by Professor Hicks in his exposition of Keynes’s contribution that there is a simple, negatively sloped function, reflecting the productivity of increments to the stock of capital, that relates investment to the interest rate is a caricature of Keynes’s theory of investment … which relates the pace of investment not only to prospective yields but also to ongoing financial behavior …

The conclusion to our argument is that the missing step in the standard Keynesian theory was the explicit consideration of capitalist finance within a cyclical and speculative context. Once capitalist finance is introduced and the development of cash flows … during the various states of the economy is explicitly examined, then the full power of the revolutionary insights and the alternative frame of analysis that Keynes developed becomes evident …

The greatness of The General Theory was that Keynes visualized [the imperfections of the monetary-financial system] as systematic rather than accidental or perhaps incidental attributes of capitalism … Only a theory that was explicitly cyclical and overtly financial was capable of being useful …

If we are to believe Minsky — and I certainly think we should — then when people like Paul Krugman and other ‘New Keynesian’ critics of MMT and Post-Keynesian economics think of themselves as defending “the whole enterprise of Keynes/Hicks macroeconomic theory,” they are simply wrong since there is no such thing as a Keynes-Hicks macroeconomic theory!

There is nothing in the post-General Theory writings of Keynes that suggests that he considered Hicks’s IS-LM anywhere near a faithful rendering of his thoughts. In Keynes’s canonical statement of the essence of his theory in the 1937 QJE article there is nothing to even suggest that Keynes would have thought the existence of a Keynes-Hicks-IS-LM-theory anything but pure nonsense. So, of course, there can’t be any “vindication for the whole enterprise of Keynes/Hicks macroeconomic theory” — simply because “Keynes/Hicks” never existed.

To be fair to Hicks, we shouldn’t forget that he returned to his IS-LM analysis in an article in 1980 — in Journal of Post Keynesian Economics — and self-critically wrote:

The only way in which IS-LM analysis usefully survives — as anything more than a classroom gadget, to be superseded, later on, by something better — is in application to a particular kind of causal analysis, where the use of equilibrium methods, even a drastic use of equilibrium methods, is not inappropriate. I have deliberately interpreted the equilibrium concept, to be used in such analysis, in a very stringent manner (some would say a pedantic manner) not because I want to tell the applied economist, who uses such methods, that he is in fact committing himself to anything which must appear to him to be so ridiculous …

When one turns to questions of policy, looking toward the future instead of the past, the use of equilibrium methods is still more suspect … It may be hoped that, after the change in policy, the economy will somehow, at some time in the future, settle into what may be regarded, in the same sense, as a new equilibrium; but there must necessarily be a stage before that equilibrium is reached …

We now know that it is not enough to think of the rate of interest as the single link between the financial and industrial sectors of the economy; for that really implies that a borrower can borrow as much as he likes at the rate of interest charged, no attention being paid to the security offered. As soon as one attends to questions of security, and to the financial intermediation that arises out of them, it becomes apparent that the dichotomy between the two curves of the IS-LM diagram must not be pressed too hard.

In his 1937 paper, Hicks actually elaborates on four different models (where Hicks uses I to denote Total Income and Ix to denote Investment):

1) “Classical”: M = kI Ix = C(i) Ix = S(i,I)

2) Keynes’ “special” theory: M = L(i) Ix = C(i) I = S(I)

3) Keynes’ “general” theory: M = L(I, i) Ix = C(i) I = S(I)

4) The “generalized general” theory: M = L(I, i) Ix =C(I, i) Ix = S(I, i)

It is obvious from the way Krugman and other ‘New Keynesians’ draw their IS-LM curves that they are thinking in terms of model number 4 — and that is not even by Hicks considered a Keynes model! It is basically a loanable funds model, that belongs in the neoclassical camp and which you find reproduced in most mainstream textbooks.

Hicksian IS-LM? Maybe. Keynes? No way!

On gender and alcohol

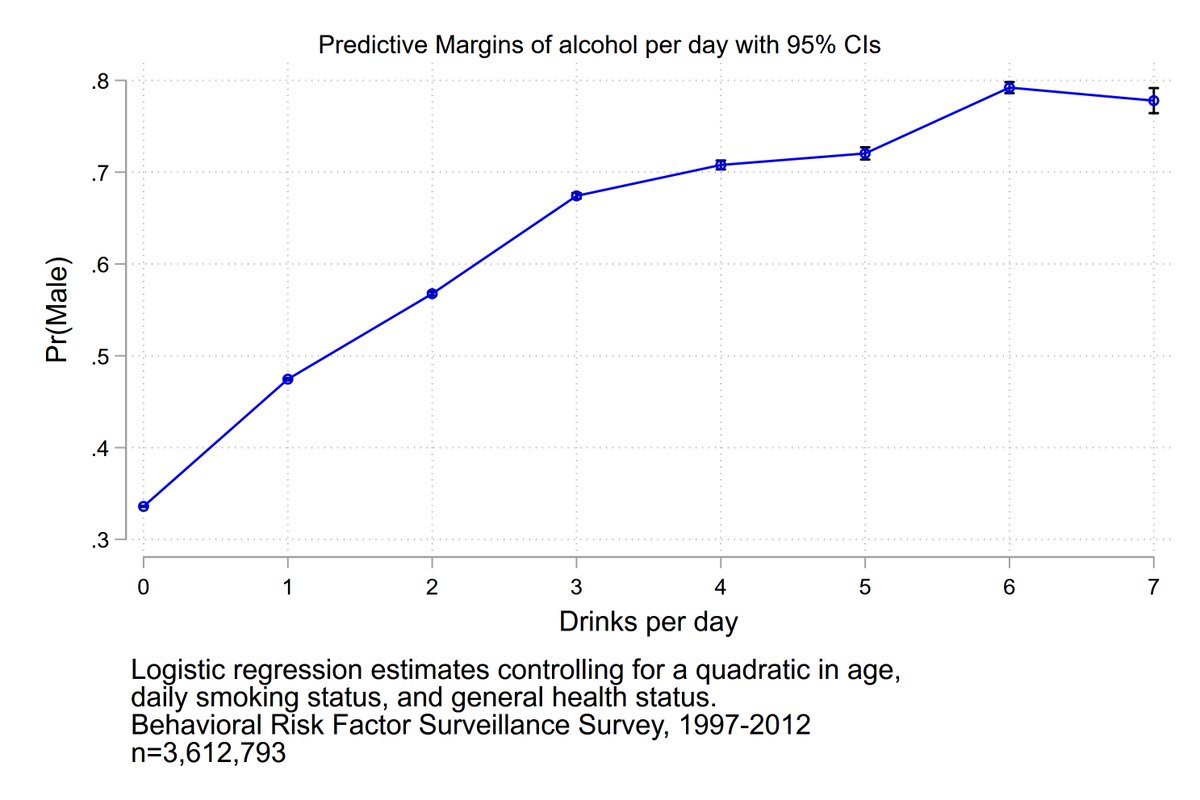

23 Jan, 2023 at 18:15 | Posted in Statistics & Econometrics | 2 CommentsBreaking news! Using advanced multiple nonlinear regression models similar to those in recent news stories on alcohol and dairy and more than 3.6M observations from 1997 through 2012, I have found that drinking more causes people to turn into men!

Across people drinking 0-7 drinks per day, each drink per day causes the drinker’s probability of being a man to increase by 10.02 percentage points (z=302.2, p<0.0001). Need I say, profound implications for public health policy follow. The Lancet here I come!

Econometric identification sure is difficult …

When in Berlin … (personal)

22 Jan, 2023 at 21:29 | Posted in Varia | 1 CommentIf 1988 or 2023 doesn’t matter — visiting Café Einstein Stammhaus is a must.

Causal inferences — what Big Data cannot give us

20 Jan, 2023 at 13:25 | Posted in Statistics & Econometrics | Comments Off on Causal inferences — what Big Data cannot give us.

The central problem with the present ‘Machine Learning’ and ‘Big Data’ hype is that so many — falsely — think that they can get away with analyzing real-world phenomena without any (commitment to) theory. But — data never speaks for itself. Data by themselves are useless. Without a prior statistical set-up, there actually are no data at all to process.

Clever data-mining tricks are not enough to answer important scientific questions. Theory matters.

If we wanted highly probable claims, scientists would stick to low-level observables and not seek generalizations, much less theories with high explanatory content. In this day of fascination with Big data’s ability to predict what book I’ll buy next, a healthy Popperian reminder is due: humans also want to understand and to explain. We want bold ‘improbable’ theories. I’m a little puzzled when I hear leading machine learners praise Popper, a realist, while proclaiming themselves fervid instrumentalists. That is, they hold the view that theories, rather than aiming at truth, are just instruments for organizing and predicting observable facts. It follows from the success of machine learning, Vladimir Cherkassy avers, that “realism is not possible.” This is very quick philosophy!

Quick indeed!

Systembrus

17 Jan, 2023 at 18:24 | Posted in Economics | 1 Comment

En vanlig missuppfattning när det gäller oönskad variabilitet i bedömningar är att det inte spelar någon roll eftersom slumpfel tar ut varandra. Det stämmer att positiva och negativa fel i en bedömning av samma fall mer eller mindre tar ut varandra och vi kommer att diskutera mer i detalj hur denna omständighet kan utnyttjas för att minska bruset. Men brusiga system gör inte flera bedömningar av samma fall. De gör brusiga bedömningar av olika fall. Om en försäkring har för hög premie och en annan för låg kan prissättningen se korrekt ut “i genomsnitt”, men försäkringsbolaget har då begått två dyrbara misstag. Om två brottslingar som båda borde dömas till fem års fängelse får domar på tre respektive sju år kan inte någon “genomsnittlig” rättvisa sägas ha skipats. I brusiga system tar felen inte ut varandra. De läggs pa hög.

Victoria Chick (1936-2023) In Memoriam

16 Jan, 2023 at 16:17 | Posted in Economics | 2 CommentsSad news has reached us today. One of the leading Post Keynesian economists, Victoria Chick, passed away yesterday at the age of 86.

R.I.P.

Blog at WordPress.com.

Entries and Comments feeds.