DSGE models — unparalleled and spectacular failures

31 Dec, 2017 at 15:12 | Posted in Economics | 3 Comments The unsellability of DSGE models — private-sector firms do not pay lots of money to use DSGE models — is one strong argument against DSGE.

The unsellability of DSGE models — private-sector firms do not pay lots of money to use DSGE models — is one strong argument against DSGE.

But it is not the most damning critique of it.

To me the most damning critiques that can be levelled against DSGE models are the following two:

DSGE models are unable to explain involuntary unemployment

In the basic DSGE models the labour market is always cleared – responding to a changing interest rate, expected lifetime incomes, or real wages, the representative agent maximizes the utility function by varying her labour supply, money holding and consumption over time. Most importantly – if the real wage somehow deviates from its ‘equilibrium value,’ the representative agent adjust her labour supply, so that when the real wage is higher than its ‘equilibrium value,’ labour supply is increased, and when the real wage is below its ‘equilibrium value,’ labour supply is decreased.

In this model world, unemployment is always an optimal choice to changes in the labour market conditions. Hence, unemployment is totally voluntary. To be unemployed is something one optimally chooses to be.

Although this picture of unemployment as a kind of self-chosen optimality, strikes most people as utterly ridiculous, there are also, unfortunately, a lot of neoclassical economists out there who still think that price and wage rigidities are the prime movers behind unemployment. DSGE models basically explain variations in employment (and a fortiori output) with assuming nominal wages being more flexible than prices – disregarding the lack of empirical evidence for this rather counterintuitive assumption.

Although this picture of unemployment as a kind of self-chosen optimality, strikes most people as utterly ridiculous, there are also, unfortunately, a lot of neoclassical economists out there who still think that price and wage rigidities are the prime movers behind unemployment. DSGE models basically explain variations in employment (and a fortiori output) with assuming nominal wages being more flexible than prices – disregarding the lack of empirical evidence for this rather counterintuitive assumption.

Lowering nominal wages would not clear the labour market. Lowering wages – and possibly prices – could, perhaps, lower interest rates and increase investment. It would be much easier to achieve that effect by increasing the money supply. In any case, wage reductions were not seen as a general substitute for an expansionary monetary or fiscal policy. And even if potentially positive impacts of lowering wages exist, there are also more heavily weighing negative impacts – management-union relations deteriorating, expectations of on-going lowering of wages causing delay of investments, debt deflation et cetera.

The classical proposition that lowering wages would lower unemployment and ultimately take economies out of depressions, was ill-founded and basically wrong. Flexible wages would probably only make things worse by leading to erratic price-fluctuations. The basic explanation for unemployment is insufficient aggregate demand, and that is mostly determined outside the labour market.

Obviously, it’s rather embarrassing that the kind of DSGE models ‘modern’ macroeconomists use cannot incorporate such a basic fact of reality as involuntary unemployment. Of course, working with representative agent models, this should come as no surprise. The kind of unemployment that occurs is voluntary since it is only adjustments of the hours of work that these optimizing agents make to maximize their utility.

In DSGE models increases in government spending leads to a drop in private consumption

In the most basic mainstream proto-DSGE models one often assumes that governments finance current expenditures with current tax revenues. This will have a negative income effect on the households, leading — rather counterintuitively — to a drop in private consumption although both employment an production expands. This mechanism also holds when the (in)famous Ricardian equivalence is added to the models.

Ricardian equivalence basically means that financing government expenditures through taxes or debts is equivalent since debt financing must be repaid with interest, and agents — equipped with rational expectations — would only increase savings in order to be able to pay the higher taxes in the future, thus leaving total expenditures unchanged.

Why?

In the standard neoclassical consumption model — used in DSGE macroeconomic modelling — people are basically portrayed as treating time as a dichotomous phenomenon – today and the future — when contemplating making decisions and acting. How much should one consume today and how much in the future? Facing an intertemporal budget constraint of the form

ct + cf/(1+r) = ft + yt + yf/(1+r),

where ct is consumption today, cf is consumption in the future, ft is holdings of financial assets today, yt is labour incomes today, yf is labour incomes in the future, and r is the real interest rate, and having a lifetime utility function of the form

U = u(ct) + au(cf),

where a is the time discounting parameter, the representative agent (consumer) maximizes his utility when

u'(ct) = a(1+r)u'(cf).

This expression – the Euler equation – implies that the representative agent (consumer) is indifferent between consuming one more unit today or instead consuming it tomorrow. Typically using a logarithmic function form – u(c) = log c – which gives u'(c) = 1/c, the Euler equation can be rewritten as

1/ct = a(1+r)(1/cf),

or

cf/ct = a(1+r).

This importantly implies that according to the neoclassical consumption model changes in the (real) interest rate and consumption move in the same direction. And — it also follows that consumption is invariant to the timing of taxes since wealth — ft + yt + yf/(1+r) — has to be interpreted as present discounted value net of taxes. And so, according to the assumption of Ricardian equivalence, the timing of taxes does not affect consumption, simply because the maximization problem as specified in the model is unchanged. As a result — households cut down on their consumption when governments increase their spendings. Mirabile dictu!

Benchmark DSGE models have paid little attention to the role of fiscal policy, therefore minimising any possible interaction of fiscal policies with monetary policy. This has been partly because of the assumption of Ricardian equivalence. As a result, the distribution of taxes across time become irrelevant and aggregate financial wealth does not matter for the behavior of agents or for the dynamics of the economy because bonds do not represent net real wealth for households.

Incorporating more meaningfully the role of fiscal policies requires abandoning frameworks with the Ricardian equivalence. The question is how to break the Ricardian equivalence? Two possibilities are available. The first is to move to an overlapping generations framework and the second (which has been the most common way of handling the problem) is to rely on an infinite-horizon model with a type of liquidity constrained agents (eg “rule of thumb agents”).

Sure, macroeconomic models have to abandon Ricardian equivalence nonsense. But replacing it with “overlapping generations” and “infinite-horizon” models — isn’t that — in terms of realism and relevance — just getting out of the frying pan into the fire? All unemployment is still voluntary. Intertemporal substitution between labour and leisure is still ubiquitous. And the specification of the utility function is still hopelessly off the mark from an empirical point of view.

Sure, macroeconomic models have to abandon Ricardian equivalence nonsense. But replacing it with “overlapping generations” and “infinite-horizon” models — isn’t that — in terms of realism and relevance — just getting out of the frying pan into the fire? All unemployment is still voluntary. Intertemporal substitution between labour and leisure is still ubiquitous. And the specification of the utility function is still hopelessly off the mark from an empirical point of view.

As one Nobel laureate has it:

Ricardian equivalence is taught in every graduate school in the country. It is also sheer nonsense.

Joseph E. Stiglitz, twitter

And as one economics blogger has it:

DSGE modeling is taught in every graduate school in the country. It is also sheer nonsense.

Lars Syll, twitter

Krugman’s misapplication of neoclassical growth models

30 Dec, 2017 at 11:11 | Posted in Economics | 5 CommentsThe fallacies loanable funds theory commits might be explainable by the misapplication of some ideas and concepts of neoclassical growth models … to the sphere of money and finance …

The Ramsey and Solow models are models of real investment only. Financial markets, financial assets and financial saving do not play any role in those models. There is only one good which, for simplicity, will be called “corn”. Corn has three functions: it can be consumed, invested and used as a means of payment since wages and interest payments are made with it. Full employment is assumed … Without money and other financial assets, the only way units can save is to increase their tangible assets, i.e. to invest …

Since the problems of different financial saving plans are not dealt with in Solow’s model, the model cannot be used to make any predictions about economic units’ financial saving behavior, its inconsistencies and thus about the paradox of thrift – neither in the short, medium or long run. There is no miraculous way of short-run financial saving somehow being transformed into long run investment in tangible assets. The two are simply quite different phenomena …

How pervasive this approach is, is shown by Eggertsson and Krugman (2012) who add some features … to a basic neoclassical model. Again, no money but goods are borrowed and lent. Naturally, potential lenders have to save some of their goods before they can lend them to borrowers. But since in the real world money is normally not eaten or planted and keeps circulating in the economy when it is spent or lent, those models cannot be any guide for the analysis of a monetary economy. Specifically, what is true in a one good economy – units have to consume less to lend and invest more – is fundamentally wrong in a monetary economy.

This should come as no surprise. Paul Krugman has repeatedly over the years argued that we should continue to use neoclassical hobby horses like Ramsey style growth, IS-LM, and AS-AD models.

Money and finance don’t matter in mainstream neoclassical macroeconomic models. That’s true. According to the ‘classical dichotomy,’ real variables — output and employment — are independent of monetary variables, and so enables mainstream economics to depict the economy as basically a barter system.

But in the real world in which we happen to live, money certainly does matter. Money is not neutral and money matters in both the short run and the long run:

The theory which I desiderate would deal … with an economy in which money plays a part of its own and affects motives and decisions, and is, in short, one of the operative factors in the situation, so that the course of events cannot be predicted in either the long period or in the short, without a knowledge of the behaviour of money between the first state and the last. And it is this which we ought to mean when we speak of a monetary economy.

J. M. Keynes A monetary theory of production (1933)

Pseudo-vetenskapligt mumbo jumbo på svenska universitet

29 Dec, 2017 at 19:11 | Posted in Education & School | 5 CommentsJag sprang nyligen på en sammanställning av genusdoktorsavhandlingar från 2014. Många godbitar. Men en av dem var särskilt anmärkningsvärd, nämligen nummer 19 i uppräkningen. Det handlar om doktors-avhandlingen “Rum, rytm och resande” från Linköpings universitet (pdf). Sammanställningen sammanfattar:

“Avhandlingen undersöker järnvägstationer som fysiska platser och sociala rum ur könsperspektiv. Kimstad pendeltågsstation, Norrköpings järnvägsstation och Stockholms Centralstation ingår i studien. Resultaten visar att järnvägs-stationerna reproducerar könsmaktsordningen och att detta påverkar både män som kvinnor som vistas där.”

En doktorand har alltså ägnat minst 4-5 år och flera miljoner skatte-kronor åt att besöka järnvägsstationer och komma fram till att “järnvägs-stationerna reproducerar könsmaktsordningen”. Doktorandens chef har planerat detta arbete och chefens chefer har godkänt det. Dessutom har en betygskommitté med externa granskare bedömt och skrivit under på att doktorsavhandlingen håller måttet.

Det var katten. Men det blir värre.

Doktorsavhandlingen sammanfattas på engelska. Det börjar med:

“Results from the study show that individuals in different ways are affected by gendered power relations that dwell in rhythms of collective believes and in shape of materialized objects that encounter the commuters when visiting the railway station. While the rhythms of masculine seriality contains believes of males as potentially violent, as defenders and as bread winners, the rhythms of female seriality contains believes of women as primary mothers and housewives, of women as primary victim of sexual violence and of objectification of women’s bodies as either decent or as sexually available to heterosexual men”.

Rytmer av könsmaktsordningen. Poetiskt.

Ja, inför sådant tyckmyckentrutat pseudo-vetenskapligt blaj kan man inte annat än taga sig för pannan.

Mitt eget favoritexempel på detta ‘vetenskapliga’ skojeri är hämtat ur ett nummer av Pedagogisk Forskning i Sverige (2-3 2014) där författaren till artikeln “En pedagogisk relation mellan människa och häst. På väg mot en pedagogisk filosofisk utforskning av mellanrummet” ger följande intressanta ‘programförklaring:

Med en posthumanistisk ansats belyser och reflekterar jag över hur både människa och häst överskrider sina varanden och hur det öppnar upp ett mellanrum med dimensioner av subjektivitet, kroppslighet och ömsesidighet.

Och så säger man att svensk universitets-utbildning är i kris. Undrar varför …

Och så säger man att svensk universitets-utbildning är i kris. Undrar varför …

The causes of secular stagnation and the loanable funds theory

28 Dec, 2017 at 09:34 | Posted in Economics | 6 CommentsWhat are the causes of secular stagnation? What are the solutions to revive growth and get the U.S. economy out of the doldrums? …

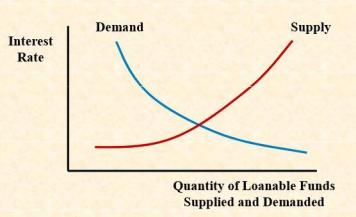

One headline conclusion stands out: the secular stagnation is caused by a heavy overdose of savings … All these savings end up as deposits, or ‘loanable funds’ (LF), in commercial banks … The glut in savings supply is so large that banks cannot get rid of all the loanable funds even when they offer firms free loans—that is, even after they reduce the interest rate to zero, firms are not willing to borrow more in order to invest. The result is inadequate investment and a shortage of aggregate demand in the short run, which lead to long-term stagnation as long as the savings-investment imbalance persists …

This is clearly a depressing conclusion, but it is also wrong …

Ever since Knut Wicksell’s (1898) restatement of the doctrine, the loanable funds approach has exerted a surprisingly strong influence upon some of the best minds in the profession …

Due to our inability to free ourselves from the discredited loanable funds doctrine, we have lost the forest for the trees. We cannot see that the solution to the real problem underlying secular stagnation (a structural shortage of aggregate demand) is by no means difficult: use fiscal policy—a package of spending on infrastructure, green energy systems, public transportation and public services, and progressive income taxation—and raise (median) wages. The stagnation will soon be over, relegating all the scholastic talk about the ZLB to the dustbin of a Christmas past.

It is difficult not to agree with Servaas here. The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credits set by banks and determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.”

It is difficult not to agree with Servaas here. The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credits set by banks and determined by supply and demand — as Bertil Ohlin put it — “in the same way as the price of eggs and strawberries on a village market.”

It’s a beautiful fairy tale, but the problem is that banks are not barter institutions that transfer pre-existing loanable funds from depositors to borrowers. Why? Because, in the real world, there simply are no pre-existing loanable funds. Banks create new funds — credit — only if someone has previously got into debt! Banks are monetary institutions, not barter vehicles.

Continue Reading The causes of secular stagnation and the loanable funds theory…

A Happy New Year to all my blog readers

27 Dec, 2017 at 23:31 | Posted in Varia | 2 Comments

Tired of the idea of an infallible mainstream neoclassical economics and its perpetuation of spoon-fed orthodoxy, yours truly launched this blog six years ago. The number of visitors has increased steadily, and with now having had my posts viewed more than 3 million times, I have to admit of still being — given the rather wonkish character of the blog, with posts mostly on economic theory, statistics, econometrics, theory of science and methodology — utterly astonished that so many are interested and take their time to read the often rather geeky stuff posted here.

In the 21st century, the blogosphere has without any doubts become one of the greatest channels for dispersing new knowledge and information. As a blogger, I can specialize in those particular topics an economist and professor of social science happens to have both deep knowledge of and interest in. That, of course, also means — in the modern long tail world — being able to target a segment of readers with much narrower and specialized interests than newspapers and magazines, as a rule, could aim for — and still attract quite a lot of readers.

Farewell to neoliberalism

27 Dec, 2017 at 09:58 | Posted in Politics & Society | 3 CommentsKR: The death of the centre-left has also led to the rise of the Right. You note … that working class white women overwhelmingly voted for Trump, while Clinton lost votes among African Americans and Latinos compared to Obama’s election in 2008. How have so many social groups associated with the Left – the working class, minorities, women – turned away?

Wolfgang Streeck:

That’s a difficult question as the “racial” complexities of American politics in particular are endless. Basically I believe that at some point material deprivation trumps (if the word is allowed) cultural identification, especially if the alternative – in this case, Clinton – is so unattractive and indeed untrustworthy. Clinton’s hobnobbing with the Californian movie stars and other celebrities, let alone her material greed and the incredible sums she collected for her Wall Street appearances, must at some point have destroyed her claim to defend “hard-working Americans and their families”. What was left then was Trump. I think we have reasons to believe that had Bernie Sanders been allowed by the Democratic party machine to will the nomination, he could have defeated Trump handily, certainly in places like Iowa, Wisconsin and Ohio.

Facebook destroys democracy

26 Dec, 2017 at 12:13 | Posted in Politics & Society | 2 CommentsZEIT: Die Monopolstellung ist also mehr als ein marktwirtschaftliches Problem?

Ferguson: Sie ist ein riesiges Problem. In der gesamten Menschheitsgeschichte galt der öffentliche Raum als nicht kommerziell. Heute haben wir daraus einen gigantischen Anzeigenmarkt gemacht. Die Suche nach Informationen ist wie der Gang in eine Bibliothek.

Durch Google ist das jetzt ein weltweiter Verkaufsraum. Dasselbe sehen Sie in der Veränderung unserer sozialen Netzwerke. Früher hatten wir Clubs und Gesellschaften, den Marktplatz oder die Kneipe, um miteinander abzuhängen und uns auszutauschen. Dieser Raum gehört jetzt Facebook, und Facebook bombardiert uns mit Werbung. Kurz gefasst haben wir also zwei Firmen, Google und Facebook, die den globalen Werbemarkt bestimmen und zugleich auch die Macht haben, den öffentlichen Raum zu dominieren. Das ist ein Zustand, der langfristig nicht aufrechterhalten werden kann. Es kann nicht sein, dass ein Privatunternehmen ein Monopol über unsere persönlichen Daten besitzt und sie einfach weiterverkaufen kann. Das ist schlicht und einfach verrückt. Genauso wie die Tatsache, dass Facebook durch seinen Newsfeed der mit Abstand größte Herausgeber von Nachrichten in der Geschichte der USA ist. Das ist desaströs für den Fortbestand der westlichen Demokratie.

Never thought I would quote Niall Ferguson, but here — for once — he has something both intelligent and thoughtful to say.

Is it time to ditch the natural rate hypothesis?

25 Dec, 2017 at 12:00 | Posted in Economics | 1 CommentFifty years ago Milton Friedman wrote an (in)famous article arguing that (1) the natural rate of unemployment was independent of monetary policy, and (2) trying to keep the unemployment rate below the natural rate would only give rise to higher and higher inflation.

The hypothesis has always been controversial, and much theoretical and empirical work has questioned the real-world relevance of the ideas that unemployment really is independent of monetary policy and that there is no long-run trade-off between inflation and unemployment.

Although Olivier Blanchard also has his doubts — after having played around with a ‘toy model’ and looked at the data — he lands on the following advice:

Failure of either of the hypothesis leads to a more attractive trade-off between output and inflation, and, in the presence of shocks, suggests a stronger role for stabilization policy. If the independence hypothesis fails, adverse shocks are more costly, and stabilization policy more powerful. If the accelerationist hypothesis fails, there is more room for stabilization policy to be used at little inflation cost.

Where does this leave us? It would be good to have a sense of … the specific channels at work. The empirical part of this paper has shown that we are still far from it. Thus, the general advice must be that central banks should keep the natural rate hypothesis (extended to mean positive but low values of b and a) as their baseline, but keep an open mind and put some weight on the alternatives. For example, given the evidence on labor force participation and on the stickiness of inflation expectations presented earlier, I believe that there is a strong case, although not an overwhelming case, to allow U.S. output to exceed potential for some time, so as to reintegrate some of the workers who left the labor force during the last ten years.

My own view on the subject is that the natural rate hypothesis does not hold water simply because the relations it describes have never actually existed.

The only thing that amazes yours truly is that although this is pretty ‘common knowledge,’ so-called ‘New Keynesian’ macroeconomists still today use it — and its cousin the Phillips curve — as a fundamental building block in their models. Why? Because without it ‘New Keynesians’ have to give up their (again and again empirically falsified) neoclassical view of the long-run neutrality of money and the simplistic idea of inflation as an excess-demand phenomenon.

The natural rate hypothesis approach (NRH) is not only of theoretical interest. Far from it.

The natural rate hypothesis approach (NRH) is not only of theoretical interest. Far from it.

The real damage done is that policymakers that take decisions based on NRH models systematically implement austerity measures and kill off economic expansion. The unnecessary and costly unemployment that this self-inflicted and flawed illusion eventuates, is something its New Classical and ‘New Keynesian’ advocates should always be kept accountable for.

According to the [NRH], unemployment differs from its natural rate only if expected inflation differs from actual inflation. If expectations are rational, we should see as many quarters when inflation is above expected inflation as quarters when it is below expected inflation. That suggests the following test of the [NRH]:

Because a decade contains 40 quarters, the probability that average expected inflation over a decade will be different from average actual inflation should be small. If the [NRH] and rational expectations are both true simultaneously, a plot of decade averages of inflation against unemployment should reveal a vertical line at the natural rate of unemployment … This prediction fails dramatically.

There is no tendency for the points to lie around a vertical line and, if anything, the long-run Phillips is upward sloping, and closer to being horizontal than vertical. Since it is unlikely that expectations are systematically biased over decades, I conclude that the [NRH] is false.

Defenders of the [NRH] might choose to respond to these empirical findings by arguing that the natural rate of unemployment is time-varying. But I am unaware of any theory which provides us, in advance, with an explanation of how the natural rate of unemployment varies over time. In the absence of such a theor, the [NRH] has no predictive content. A theory like this, which cannot be falsified by any set of observations, is closer to religion than science.

So, yes, it is definitely time to ditch the natural rate hypothesis!

Trumpian trickle down

25 Dec, 2017 at 11:08 | Posted in Economics | 1 Comment

Trump and the GOP delivering a huge gift to US corporations and shareholders. The only trickle down to workers going on is probably best described in analogy to the above picture …

O holy night

24 Dec, 2017 at 18:23 | Posted in Varia | Comments Off on O holy night

Absolutely outstanding. Divine.

If only Trump had read Abba Lerner!

21 Dec, 2017 at 13:12 | Posted in Economics | 4 CommentsThe first financial responsibility of the government (since nobody else can undertake that responsibility) is to keep the total rate of spending in the country on goods and services neither greater nor less than that rate which at the current prices would buy all the goods that it is possible to produce. If total spending is allowed to go above this there will be inflation, and if it is allowed to go below this there will be unemployment. The government can increase total spending by spending more itself or by reducing taxes so that taxpayers have more money left to spend. It can reduce total spending by spending less itself or by raising taxes so that taxpayers have less money left to spend …

In applying this first law of Functional Finance, the government may find itself collecting more in taxes than it is spending, or spending more than it collects … In neither case should the government feel that there is anything especially good or bad about this result; it should merely concentrate on keeping the total rate of spending neither too small nor too great, in this way preventing both unemployment and inflation.

An interesting, and to many a shocking, corollary is that taxing is never to be undertaken merely because the government needs to make money payments. According to the principles of Functional Finance, taxation must be judged only by its effects … Taxation should therefore be imposed only when it is desirable that the taxpayers shall have less money to spend, for example, when they would otherwise spend enough to bring about inflation …

High income taxes need not discourage investment, because appropriate deductions for losses can diminish the capital actually risked by the investor in the same proportion as his net income from the investment is reduced.

Blog at WordPress.com.

Entries and Comments feeds.